By Kevin Mattice, Chief Product Officer

You’re barraged by real estate data sales pitches every day. Buzzwords like AI, Moneyball, or Bring-Your-Own-Data Visualization layers.

But you rarely hear about implementations that drive ROI. That’s because most sales pitches are bullsh*t: The pitch looks exactly like what you wanted, but in reality the product is not what you needed at all.

Even if a magic AI solution existed, it would be overblown, expensive, and timely to execute. And it’s not even what you really need.

You need to know:

You need a data insights and integration engine that serves as your single source of truth, to answer any question – including ones you haven’t thought of yet.

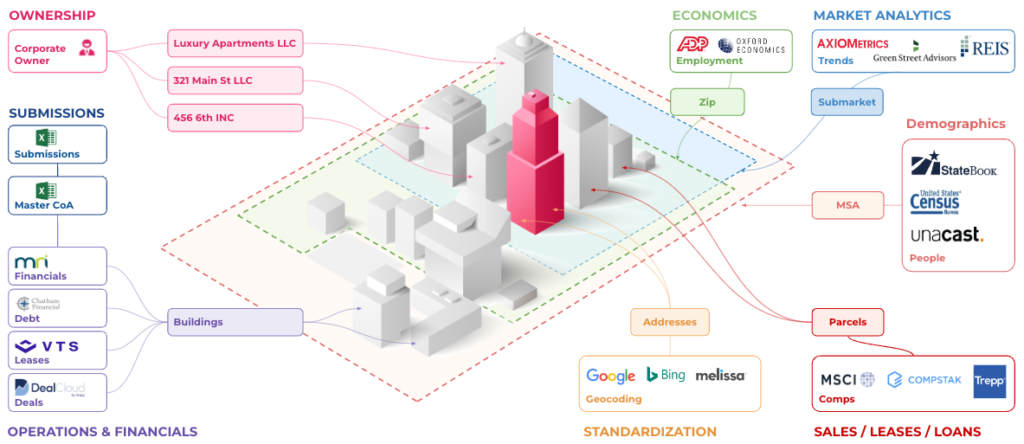

Real estate data is disparate, incomplete, siloed, and fundamentally incompatible. Your data does not speak the same language, and you need more than a database or data pipelines.

You can’t afford to be offline. Comprehensive monitoring of your entire architecture is essential to ensuring that your front-end products, models, and reporting continue to power your business.

How are you ingesting and egressing your data? You need an architecture that can support multiple API sources, different types of file delivery (like CSV and Excel), and direct database connections.

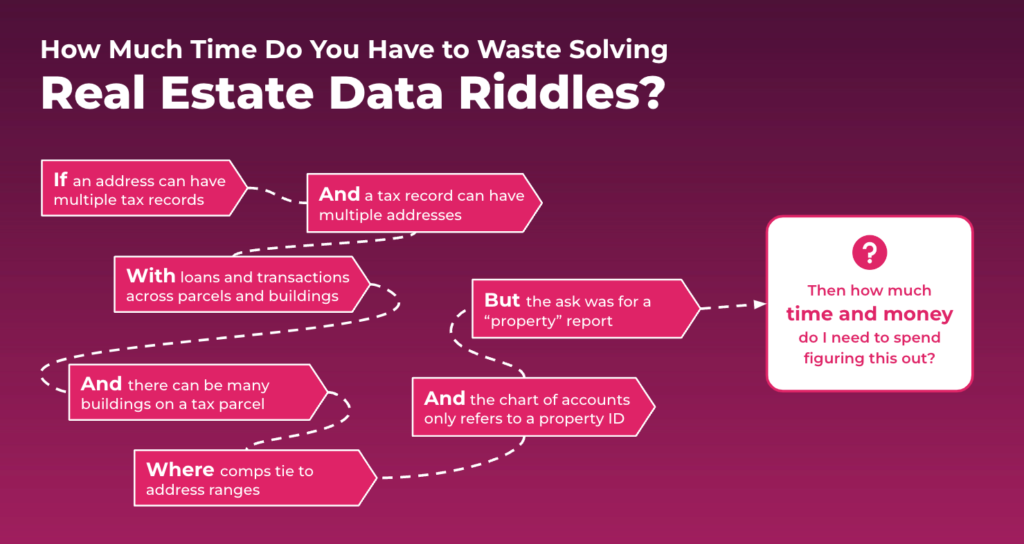

Untangling the web of real estate data is an exercise in riddle-solving.

To get the most out of your data strategy, you’ll need to integrate data from benchmarking, POI, transaction, and economic providers – plus deal, valuations, modeling, loan, risk management, property management, and ESG applications throughout the lifecycle of your asset. And each one has their own data dictionary and schema.

A centralized data strategy works only if everyone uses the same data. Ensure your architecture supports the entire investor lifecycle, from disposition to acquisitions to value enhancement.

You need one set of standardization services across all of your data, including addresses, names, and geospatial aggregates.

(Pro-tip: Cherre has built the largest Real Estate Knowledge Graph that we use as the fabric for our data connection engine. We’re one of the few companies who have a view of the entire world of real estate data in a single data model.)

Don’t waste resources on something that isn’t your core competency. No real estate company has driven higher returns because they excel at data engineering.

Yes, building a data engine yourself is certainly possible – if you have a limitless budget and timeline.

Sourcing engineers and product managers to get your data to a point where you can drive meaningful value across the organization can take years and millions of dollars — and those resources could be better spent building strategic differentiation.

Maintaining your data infrastructure with 24/7 internal support is not a strategic differentiator.

Paying for data providers and licenses is not a strategic differentiator.

Reinventing the wheel as you continue to evolve your architecture is not a strategic differentiator.

The differentiator comes from the analysis and insight you drive with that data.

At Cherre, we don’t cut corners. We sort, normalize, and resolve all your data within a safe and secure infrastructure – for a fraction of the time and cost it would take to do it on your own.

Cherre has helped the world’s leading real estate companies unbullsh*t their data strategies, powering $2.9 trillion AUM for our customers.

Schedule a demo to learn how Cherre can un-bullsh*t your data strategy, too.