Being a startup can be stressful sometimes, especially in times of market volatility and uncertainty. With the decrease in VC funding and headlines of a pending recession, it’s easy to focus on the negative and assume the worst.

We’re happy to say that is not the case at Cherre.

We just closed another record quarter, not only in terms of new and expansion ARR, but also in team growth, new customers, product maturity, market expansion, assets under management powered by Cherre, and thought leadership. As an industry leader and a trendsetter, our growing successes underscore the shift to a unanimous consensus that real estate organizations need a unified and centralized data environment.

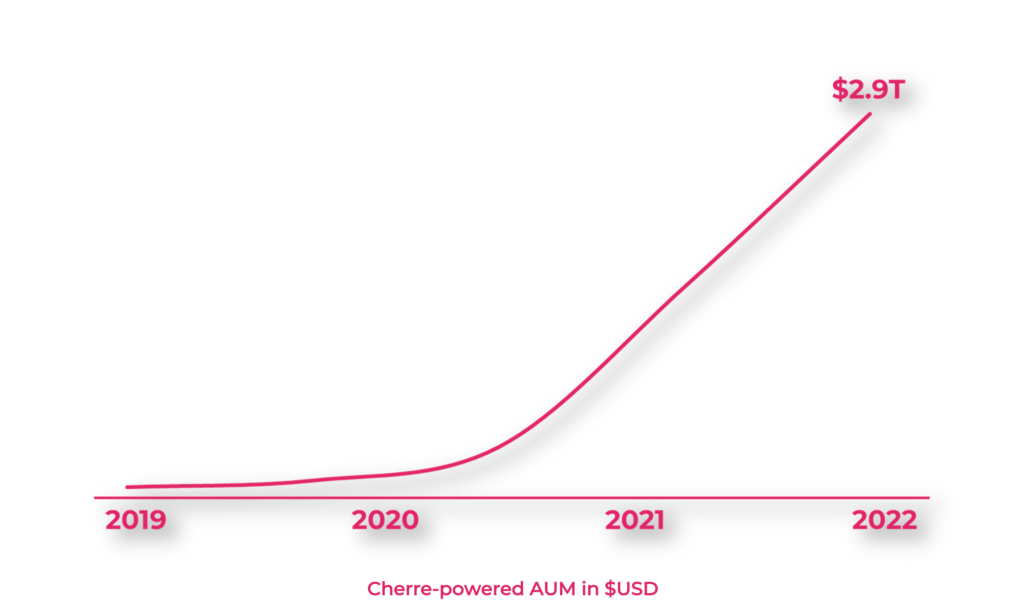

In Q2 we grew our ARR by 79% and our client count by 78% YoY. While public markets declined in Q2 among rising interest rates, we grew our ARR by 20% quarter-over-quarter. Expanding our customer base pushed Cherre-powered AUM to $2.9 trillion!

Our growth in the midst of a market downturn demonstrates that the real estate industry views investment in data and technology as a critical component of future strategy. They see the tremendous opportunity to build or sustain a competitive advantage with their data in the next market cycle, and trust Cherre to power their data-driven investment, disposition, and growth decisions. Those looking to cut operational costs also look to Cherre to power their efficiency initiatives as an added advantage.

This past quarter, we took our first steps toward international expansion. We added some of the largest asset managers in Europe to the platform, as well as introduced building footprint data for the UK and Canada into CoreConnect. While we’ve always been able to connect a customer’s international internal data, integrating third-party data posed a challenge because we didn’t have international property-level reference data in our Foundation data fabric. As we further weave these new cardinal datasets into Foundation, we’ll further increase our ability to support more international use cases.

In Q2 we grew our partner network by 90% YoY, adding new data and application providers to our Connections Marketplace. These new partners have expanded our ability to integrate data from broader unstructured sources and vertical-specific applications, as well as layer-in IoT systems into our CoreConnect platform.

The data partners we added in Q2 enable our customers to seamlessly expand their data universe to include different types of location data, school rankings, crime risk, and environmental data.

We also launched new Cherre Lightning Connections from SafeGraph, RentRange, CompStak, and Zoneomics. We continually add new Lightning Connections, making it even easier for customers to evaluate, purchase, and integrate new datasets.

Our customers frequently tell us that they selected Cherre because of the breadth and depth of our connected partner network. They want to easily scale and add new datasets to support their evolving growth strategies in the fluctuating market. The ecosystem we’ve built with our application and data partners powers that growth and evolution.

We accelerated our product roadmap this year and launched some really cool features:

There are so many more features on our roadmap that empower our customers to more easily connect their data into a unified and centralized data environment to support real-time reporting, analytics, and forecasting.

While the market has slowed down, our customers haven’t – so we continue to expand our team to better support rapid customer growth. Our team has grown by 75% YoY, and we added expertise in data science, operations, sales, marketing, product, and engineering.

We added key people to our Board of Directors to help support us in our exponential growth including Julia Liuson, President of Microsoft’s Developer Division, and Bill Murphy, Managing Partner at Cresting Wave, and previously founding CTO at Capital IQ and CTO of Blackstone. Both Julia and Bill’s records of driving tech adoption and evolution, as well as establishing strong partnerships among key technology stakeholders, will be a great asset as we continue to grow. We also added former PwC Vice Chairman and Wells Fargo Board Member Juan Pujadas as a strategic advisor.

Cherre hosted its inaugural Data Summit in May, the first event bringing together technical leaders and do-ers from the real estate industry. Many events in the industry are tech-adjacent, and feature speakers and panels that discuss having a data strategy with various PropTech companies in the space. However, they don’t talk about actually building products, the solutions and technologies needed, actual use cases from the technical teams, etc. We wanted to bring that to the industry.

And we did.

The first Cherre Data Summit was a huge success, with over 150 technical people from leading enterprise real estate companies such as Blackstone, Brookfield Properties, Greystone, Starwood, and even technologists from Google. The day included keynotes from CIOs and technical leaders, as well as breakout sessions that covered everything from data deep dives from our partners, to machine learning, Big Data, data architecture, data governance, and data tooling.

Our Data Summit demonstrated how much the technical leaders and do-ers in the real estate industry want to have these types of deep technical conversations and learning opportunities, so we will continue to lead the industry.

Any way you slice or dice it, we’ve had a phenomenal quarter despite current market headwinds. The products we’re building and the conversations we’re driving in the industry continue to push us collectively forward in new ways.

As we said earlier this year, we are both proud and humbled to work with the largest vendors in the world to serve the most sophisticated clients in the world. We’re still learning new use cases, and discovering new challenges and opportunities every day.

This is a journey we are on together with the industry. Our success is directly tied to our customers’, and shapes the industry as a whole. We have a mission as well as a responsibility to continue to add value to the entire industry, and we have a lot more to learn in order to do that consistently. We look forward to this and we have no intention of slowing down.