By Peter Ferramosca, Cherre Solution Architect

In the dynamic landscape of real estate fund management, the emergence of megafunds has reshaped the industry’s paradigm. These financial behemoths have drawn substantial capital from institutional investors, transforming the sector. Simultaneously, smaller funds face unique challenges, aggravated by economic uncertainty and the recent upheaval in interest rates.

In this article, I explore how this landscape evolved, crucial lessons from funds that made strategic investments during economic downturns, and insights into how smaller funds can hold their own against the real estate Goliaths by differentiating their strategy through AI and connected data. (See also: “Most AI and machine learning strategies are bullsh!t.”)

The real estate fund management industry has evolved and expanded significantly over the past few decades. Historically, real estate fund managers were primarily focused on managing money for high-net-worth individuals and families. However, institutional investors (such as pension funds, endowments, and sovereign wealth funds) also began noticing the stability, return potential, and diversification benefits of adding real estate to their portfolios.

As institutional investors began channeling their more substantial capital into real estate, the size and number of funds grew dramatically. This change, coupled with the rise of indirect investing, led to the creation of larger funds that can be more cost-effective for investors and can reap the benefits of economies of scale.

Capital from institutional investors continues to be funneled primarily into these megafunds – like Brookfield, Starwood, and Nuveen – posing a challenge for smaller funds.

Amid the broader backdrop of the battle between smaller and larger funds, interest rate increases by the Federal Reserve over the last few years have led to a substantial increase in the cost of capital. This complicates the field for all investors, but smaller fund managers have once again been hit the hardest.

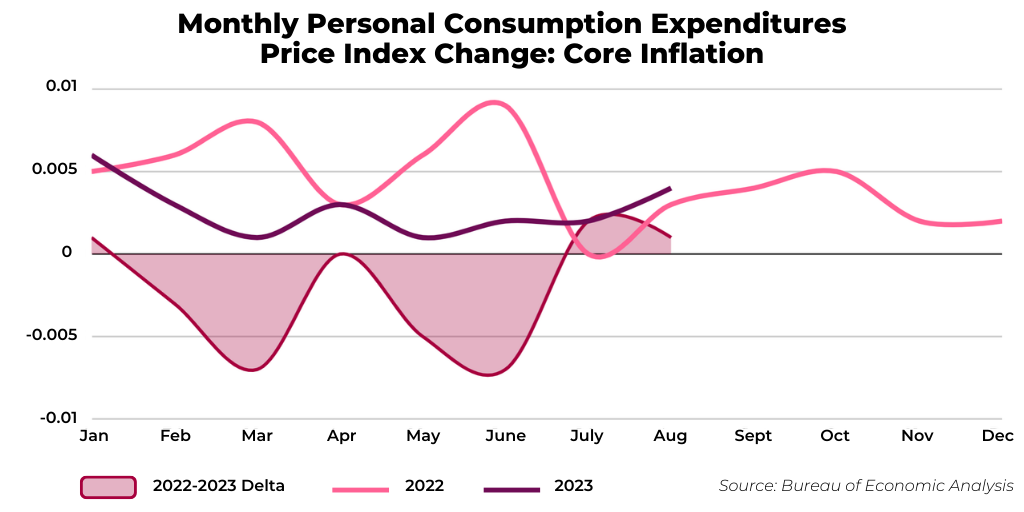

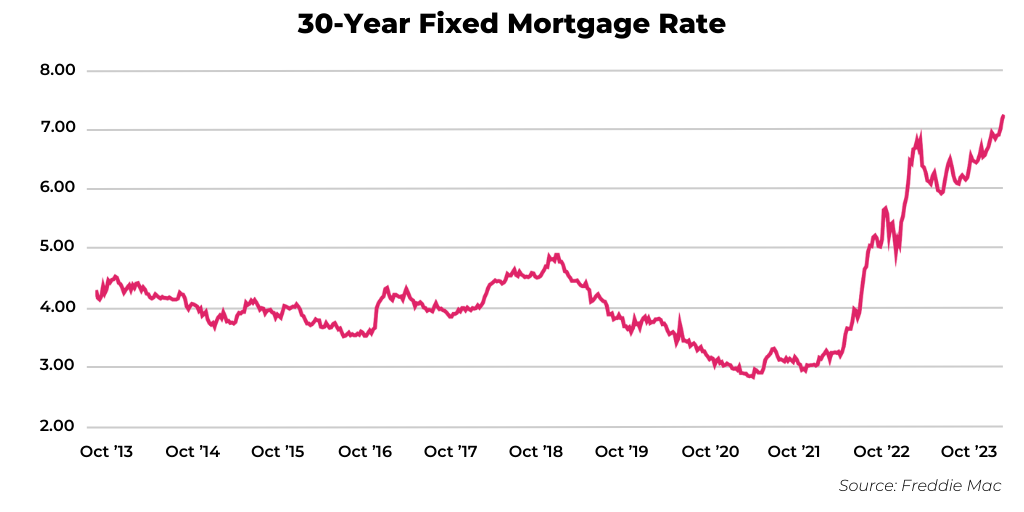

On an annualized basis, 2022 averaged a monthly Personal Consumer Expenditures Price Index Change of 5.3%, whereas 2023 has averaged 3.3% through August, according to data from the Bureau of Economic Analysis. When inflation peaked towards the end of 2021, the Federal Reserve began hiking interest rates to reduce demand in increments to the point that 30-year fixed mortgage rates have climbed to 7.57%, according to Freddie Mac data.

To put this in perspective, interest rates were 2.65% in January of 2021, indicating that actions enacted by the Federal Reserve have increased the cost of mortgage financing options by over 180% since 2021.

Rising interest rates, along with the inflation targeted by the Fed, have made deals harder to pencil out. As we’ve seen throughout 2023, deal volume is down significantly compared with 2021 and 2022, although those two years saw historically high deal volume. Fund managers must factor in these characteristics when setting return targets, and promising investment opportunities lose significant potential due to impact of financing costs on overall project cost.

Larger institutional investors like Blackstone, with ample dry powder to invest, experience less financing risk from these capital market conditions, leveraging to enhance returns. They can pursue investments with lower loan-to-value ratios and opportunities that smaller fund managers cannot even consider.

Deploying capital during a downturn can be a good idea. Pricing becomes attractive when investment volume declines. With opportunities to buy assets below replacement costs, there can often be clear upside despite financing and other capital costs.

In addition, investors who deploy capital during market uncertainty tend to cement their advantages, achieve a long-term competitive edge, and accumulate significant market share.

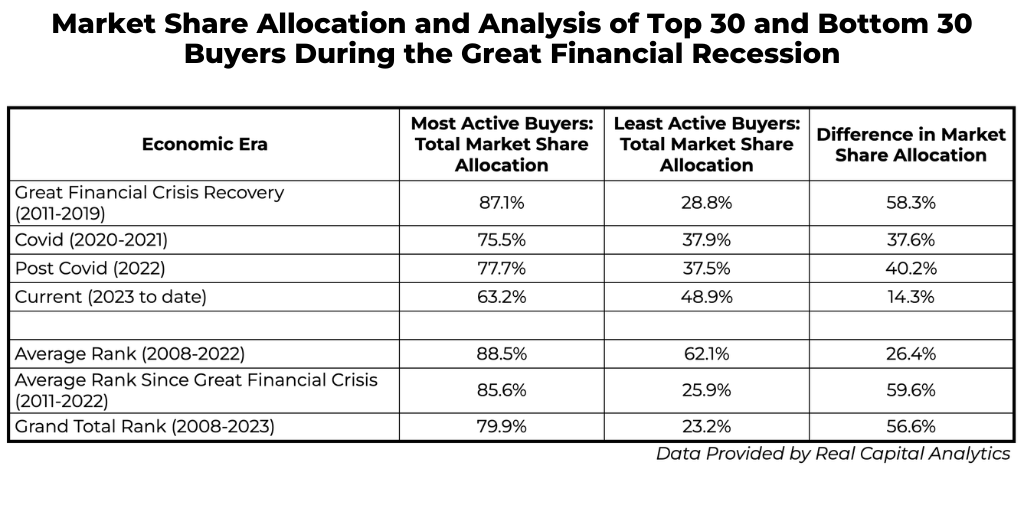

These themes are evident in Cherre’s analysis of 222 investors, both small and large, that have historically been very active. We focused on the firms that were the most and least active buyers during the Great Financial Crisis, examining their behavior during subsequent recoveries and downturns.

Our data shows that the top 30 firms making significant investments during the Great Financial Crisis were able to continue doing so in subsequent periods of market uncertainty. These firms gained substantial market share comparatively, providing them new ability to scale – especially when compared to firms that did not (or could not) invest heavily during the Great Financial Crisis.

As the table shows, these firms were tremendously outpaced by the other firms – which did not go unnoticed by limited partners (LPs) and other capital providers. Large fund managers able to utilize economies of scale certainly have an advantage in attracting institutional capital through extensive track records and established relationships. In fact, Preqin cited in a recent newsletter that LPs seek general partners (GPs) and sponsors with experience, transparency, and good governance when choosing fund managers.

Because our analysis included both large and small firms, this is not just a case of the bottom 30 being small firms that just missed the boat during the Great Financial Crisis. Rather, they were unable to (or chose not to) invest during that time and the following years, waiting for market conditions to recover.

But waiting means losing. On that topic, I recently had a conversation with a tax-advantaged real estate fund manager about its strategy during COVID and its short-lived economic downturn. This firm is one of roughly 25 such firms in the United States dedicated to these types of investments. Although most of the other firms stopped buying during that period, this firm continued investing and expanding. As a result of its growth and success during the pandemic when its peers sat on the sidelines, 2022 marked a record year for equity raising for the firm – about 20 percent higher than 2021 – and established the firm as one of the top three tax-advantaged real estate fund managers in the nation.

Savvy investors will continue to pour capital into the market, despite (or even because of) current market instability. According to data from NAREIT and CoStar, total assets under management in U.S real estate exceeded $20 trillion as of mid-2021. Hundreds of billions of dollars in dry powder is dedicated to U.S. real estate, according to data from Preqin, Newmark, and insights from industry experts. And even more fund managers are available to help them invest – their numbers have grown by 29 percent since 2018.

In this current environment, it may seem like investment megafunds such as Blackstone, Brookfield, and Starwood have all the advantages, such as established relationships and scalability.

How then can smaller fund managers compete for capital within an increasingly competitive market alongside giants with billions upon billions of AUM already? Fund managers can highlight strong backgrounds in asset management, as well as the ability to harness and utilize data analysis and intelligence to drive higher, more consistent cash flows to create value across the life of the investments in a fund. In short, they need clear differentiators to set themselves apart.

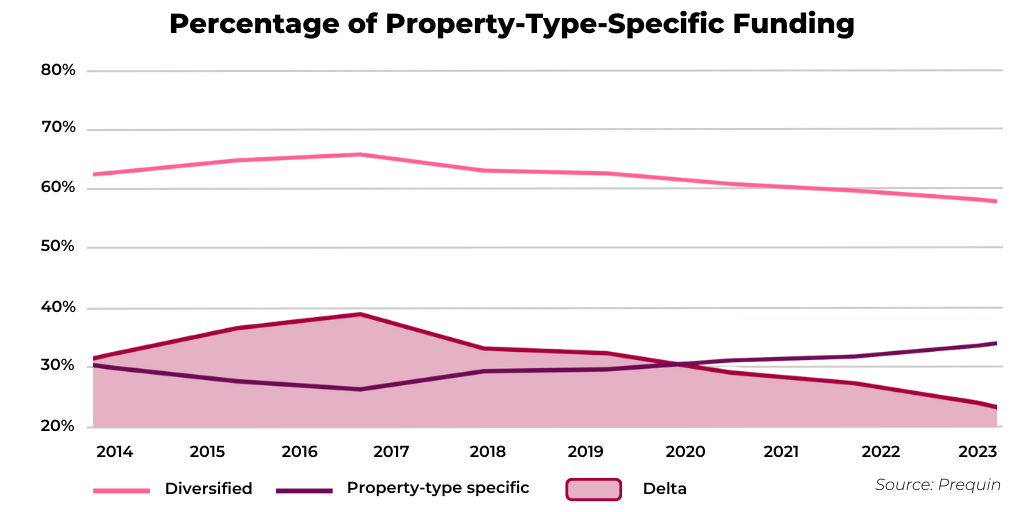

Investment in diversified funds has been on the decline during the past few years. At the same time, funds focusing on a single property type have begun to grow, with the two approaching a similar trajectory towards each other in the middle.

It is crucial to note that ‘Diversified Funds’ in this context might not necessarily capture the true essence of the benefits of diversification. Similar property types can still add diversification to a portfolio – for example staggering leases in two office buildings can stabilize cash flow and reduce vacancy loss for the portfolio as a whole, which limits risk across the portfolio.

Investment managers who can demonstrate their expertise and specialization with one or two asset types can capitalize on this interest in property-specific funds.

Many markets as a whole are experiencing strong headwinds in today’s uncertain economic environment, but opportunities exist if you know how and where to look. For example, Chicago is experiencing a mass out-migration from the market as a whole. However, within Chicago, the West Loop and Fulton Market areas remain popular retail and entertainment districts with an abundance of new, high-quality apartments. And in George, a port deepening project in Savannah is drawing interest in an otherwise lackluster area.

Investment managers who have deep knowledge of local markets can leverage this to their advantage when trying to attract capital from investors.

Many investors are looking for an investment manager with a data-backed, AI-powered approach. Most small firms do not have the engineering resources or ability to build this capacity in-house, and so turn to one of the many off-the-shelf market selection tools available. But not all are created equal: They are typically one-size-fits all, very superficial, and not tailored to the specific needs of the investor.

For a more tailored and sophisticated approach, many investors and managers are now turning to Cherre. By blending artificial intelligence and market-leading data, Cherre’s Benchmarking Data Kit offers a data model that mirrors a firm’s institutional knowledge – providing immediate value and continually improving as it learns alongside its users for market and submarket research, comparative strength analysis, portfolio benchmarking, and more.

In down markets, it’s always more difficult to find compelling investment opportunities – but they still exist. The emergence of the digital age of real estate is helping to solve that information gap. However, many investors are still trying to wait out interest rates. (I suppose they haven’t heard the countless statements by the Federal Reserve about its “higher-for-longer” plan for interest rates.)

With such growth in the number of fund managers and the types of real estate investment managers that now exist, coupled with an increasing amount of data resources that can help drive insights into singular aspects of a real estate business, we have entered a world where true value is revealed by utilizing sophisticated data analysis to convey the ideas and theses of fund managers.

Real estate investment is typically a long-term play, depending on the investment strategy, of course. However, with new ways of analyzing markets, utilizing AI to synthesize knowledge and insights into predictive signals leads to outperformance in many areas. In that context, investors using their own internal data, experience, and knowledge to feed AI models will determine the real estate islands of prosperity, so to speak, among troubling seas and will then, in Hernán Cortés’ words, “burn the ships.”

Peter Ferramosca is a Solutions Architect at Cherre. He has extensive experience in real estate and econometric data analysis, specifically as it relates to submarket structural dynamics and their relation to real estate performance. He has advised major institutional real estate market participants in consultative roles with regard to market selection, capital allocation, and real estate investment potential across all U.S. markets.