By L.D. Salmanson, Co-Founder and CEO of Cherre

In this four-part series, I take a birds-eye view of the world of real estate data and technology that we inherited. Only after we understand the historical context can we identify opportunities to use technology to fundamentally shift how we invest, manage, and transact this global asset class called real estate. Read previous article: The Evolution of the Real Estate Data Ecosystem

As someone who had the privilege of living through the (r)evolution that occurred in the financial industry, as both an operator and investor, it’s obvious to me that the transformation happening as we speak in the real estate industry looks very similar to what we experienced there not too long ago.

There are many reasons this cataclysmic shift happened in financial services first, and there are equally good reasons why the real estate industry took so long to go through its own process.

The Fintech revolution didn’t happen all at once. It happened in waves.

Historically, transactions in public equity mostly took place manually. However, starting in the 1970s, and more frequently in the 1980s, trading volume shifted to electronic trading platforms. Electronic Communication Networks, or ECNs, have been around on paper since 1969 with the creation of Instinet (today owned by Nomura).

It wasn’t until the mid-70s that the SEC adopted the Securities Acts Amendments of 1975, encouraging the “linking of all markets for qualified securities through communication and data processing facilities.” The 1980s and 1990s were a boon for electronic trading, and by the end of the 1990s, most major asset classes were primarily traded on electronic exchanges. Even so-called “dark pools” are today predominantly electronic in nature.

Electronic trading of financial assets makes sense: Financial assets are essentially homogeneous, and have certain information standards on which all trading counterparts agree. An exchange only needs to standardize the asset ID, a ticker or CUSIP, if you will, and bidding practices to create conformity.

Real estate investment, as an asset class, is a risk-averse discipline. Lower risk, and lower returns. Therefore it’s not surprising that real estate companies were not early adopters.

From there the shift to institutional dominance and algorithmic trading became obvious as well, and dominated the trading markets. Once public assets graduated to electronic mechanisms, entrepreneurs then shifted their attention from capital markets and asset management to all the aspects of financial services – including digital banking, payments processing and networks, payroll and benefits, accounting and finance, fraud and compliance, and many other overlapping areas.

This happened really fast. In the late 1990s the vast majority of firms focused on capital markets, but in the early 2000s we saw an explosion in almost every sub-sector of finance. Billions of investment dollars went into budding companies, and massive financial outcomes followed. Finance as we knew it in the 90s was completely transformed in almost every area.

So where was real estate – the largest asset class in the world – during this time? Well, it was predominantly dormant.

Real estate investment, as an asset class, is a risk-averse discipline. Lower risk, and lower returns. Therefore it’s not surprising that real estate companies were not early adopters. Instead, they sat on the sidelines and observed the world of finance being reshaped in front of their eyes. Being geographically fragmented and composed of heterogeneous assets didn’t help with early adoption either.

We would have expected the real estate industry to jump into tech adoption in the late 1990s, but the dot.com bust changed everyone’s plans. High-risk software adoption became out of the question for a traditional and risk-averse sector.

2012, as it turns out, was the first year that real estate sector began to consider investing in technology – albeit cautiously.

9/11 immediately followed. While not directly affecting global real estate or software markets, 9/11 had a profound influence on the real estate industry. NYC, in many ways, is the epicenter of global real estate investing. Besides being one of the largest markets in the world, many of the largest real estate families are headquartered in the city, as are many of the brokerage firms, banks, and capital sources to finance deals. They all came to a standstill after 9/11. This was a profound shock to the system, and the thought of adopting or starting new technology initiatives at such a time was incongruous with the general sentiment.

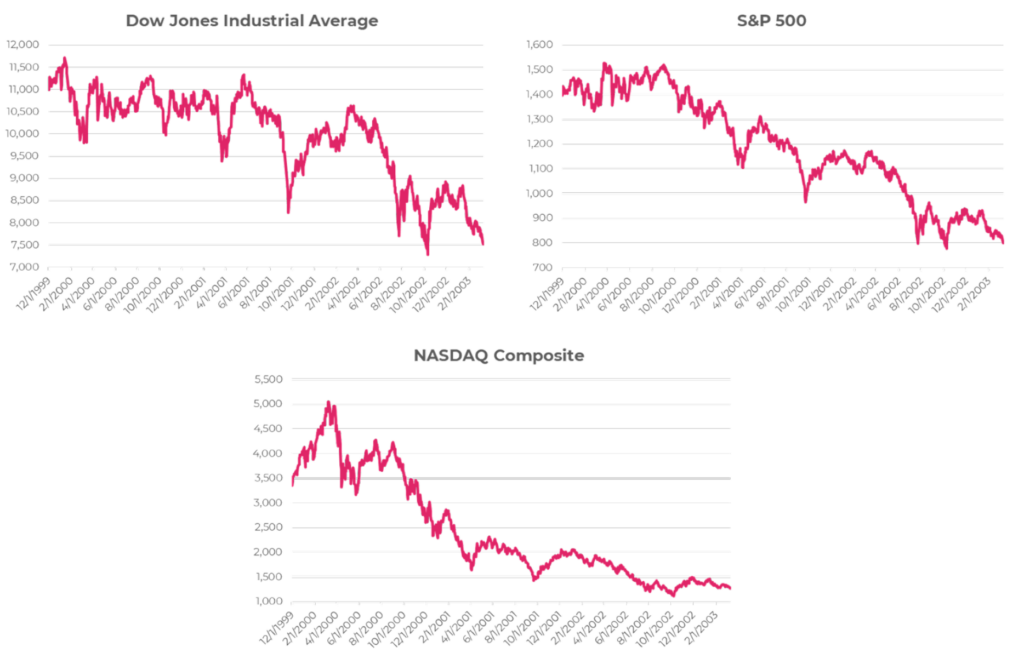

The U.S. economy was in a recession until November 2001, but the sentiment of 9/11 in the real estate sector, for all intents and purposes, remained recessionary. September 24 of 2002 marked a four-year low for the Dow. The market remained depressed through the end of 2002, and the bear market didn’t really end until March of 2003, with the Dow closing below 7500. The Dow had lost ~30% of its value during that time. In 2000, the Dow lost 6.17% of its value, in 2001, 5.35% of its value, and in 2002, 16.76% of its value. The Nasdaq, heavily weighted toward technology stocks, had lost ~45% of its value. In 2000, the Nasdaq lost 39.28% of its value, in 2001, 21.05% of its value, and in 2002, 31.53% of its value.

This was not going to be the time for real estate to invest in technology.

2004 turned out to be a rallying year for equities. However, still sore from the losses over the past five years and still cautious about investing in longer-term initiatives, the real estate sector was bearish on technology investment. The Great Recession from 2007 to 2009 was the final nail in the coffin for any such initiatives. Decimating trillions of dollars in real estate value, both direct and derivative, it would take years for the industry to recover. In fact, GDP levels didn’t return to the pre-recessionary level of $15 trillion until Q3 of 2011.

2012, as it turns out, was the first year that the sector began to consider investing in technology – albeit cautiously.

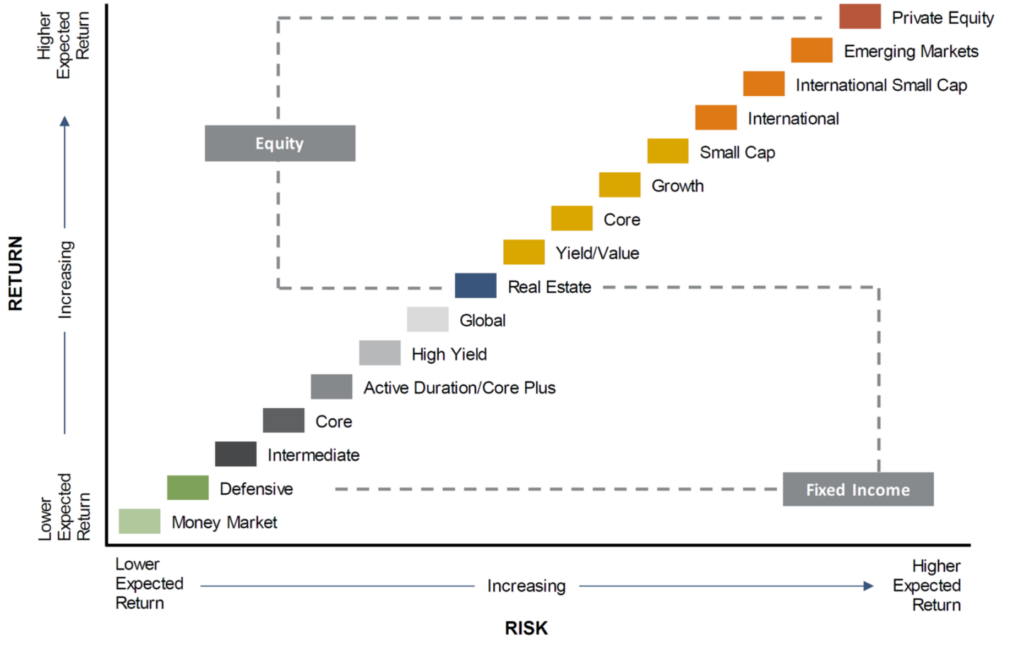

For every level of risk there’s an expected return.

Imagine a two-dimensional chart with risk representing the X axis and reward, the Y axis. U.S. Government Bonds are essentially risk-free and provide low return, and would be on the bottom left. Large-cap bonds are a bit riskier and come with a higher expected return, and will be a bit up and to the right. Continuing up and to the right we will find all other asset classes, with higher risk-reward assets, such as commodities or crypto assets being on the top right.

While any single period of time will often show discrepancies in the order, over time this model tends to reflect reality.

More importantly, this is how investors price assets and return rate expectations.

Real estate is somewhere in the middle, leaning towards the bottom left – especially for Core real estate assets: moderately low risk, with a moderately low return.

Low(ish) risk and low(ish) returns aren’t typically the most lush grounds for technology investment. The margin of error isn’t broad, and the overall operating margins of real estate assets, portfolios, and funds are fairly slim.

A line item for technology investment or adoptions typically doesn’t exist. The Operating Expense (OPEX) lines are set during underwriting, and typically do not include room for additional innovation adoption. The slim margins wouldn’t allow that to change over time typically.

Technology risk is simply not part of the DNA of real estate investors.

Capital Expense (CAPX) lines could, in theory, accommodate technology investment, but only at the point in time in which the transaction took place and if the investment was considered during the budgeting phase. That’s not to say that an adoption of a cost-cutting platform couldn’t find its way into a OPEX line, but the ROI for any technology deployment is often not immediate, so it would require a leap of faith on the investors’ or operators’ part to adopt.

Given that these technologies often become obsolete before the end of any given OPEX budget and a real estate investment assumes a 7-10 year period, the proposed value of a given solution might be much less than expected.

Technology risk is simply not part of the DNA of real estate investors.

Up next: The Evolution of Silos