By L.D. Salmanson, Co-Founder and CEO of Cherre

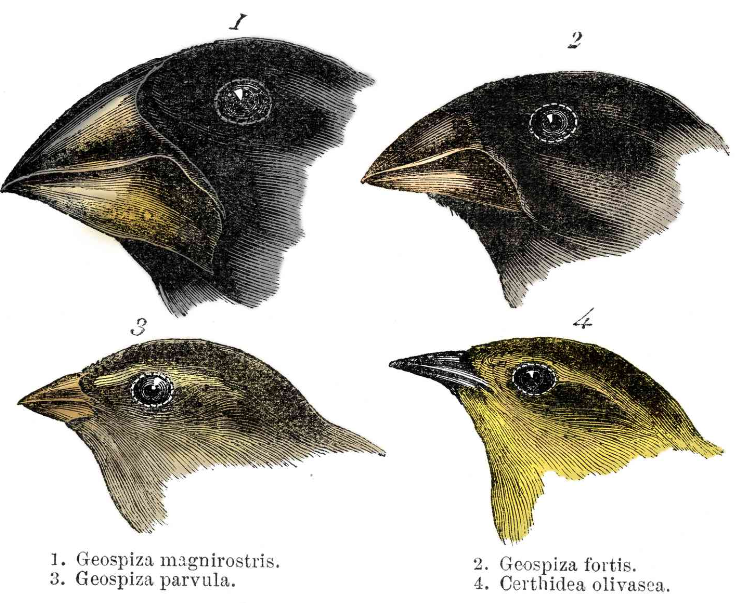

Did you ever sit and study the beaks of birds? (Yeah, me either.) But the beaks of the Darwin finches of the Galapagos Islands are truly fascinating.

In the arid landscape of the Galapagos, the medium ground finch stands out among the rocks and cacti. Its beak is a finely tuned instrument, perfectly adapted to crack open the hard, spiky seeds abundant on the islands.

This finch is one of a dozen species of Galapagos finches first discovered by the famous Charles Darwin in the 1830s.

Similar in many ways – body shape, size, breeding habits, etc. – these birds are completely separate species and don’t interbreed or interact. Each species evolved separately, with a beak uniquely adapted to its particular ecological niche.

The evolution of these finches reminds me a lot of real estate data: So many similarities, yet inherently incompatible and reflective of the evolution within a unique, siloed niche.

In this four-part series, I take a birds-eye view of the world of real estate data and technology that we inherited. Only after we understand the historical context can we identify opportunities to use technology to fundamentally shift how we invest, manage, and transact this global asset class called real estate.

It’s easy to look at a market at any single point of time and be critical. Things always look out of place if you ignore the unique past that led up to a specific moment in history.

It’s also very easy to look at said market at said point of time and think irreverently. “This makes no sense,” one might think. “I will change this reality,” one might imagine. However, it’s only through a deep understanding of the past that one can have meaningful reflections about the current reality, and what might be done to evolve into the reality we envisage.

Real Estate Technology, or PropTech as it’s often called, is no different. It’s easy to look at how siloed and incongruent real estate applications are, or how siloed and inaccurate data vendors have become, and rush to erroneous conclusions. One might think that it’s a result of bad management or methodologies on the vendor side, or lack of willingness to take risk or adapt on the operator side. While there are surely some cases where that’s true, by and large those assumptions would be ridiculously stupid.

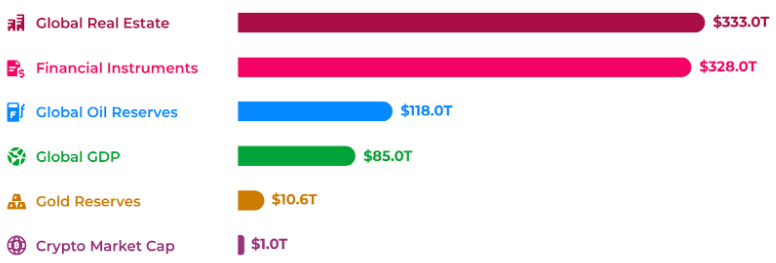

Real estate, as an asset class, is the largest in the world – by far! Global Real Estate is a $300T+ asset class, and if you add in structured products, such as CMBS/RMBS and REITs from the Financial Instruments column, as well as infrastructure assets from Oil or Mining for example, it further exacerbates the difference. Real Estate as a category is massive. It’s so massive in fact that we can often confuse it to mean one thing.

Herein lies the beginning of our problem.

Real estate means many things. It’s so fragmented from a business standpoint that anything we think of downstream will surely be fragmented as well. Are we thinking about residential or commercial real estate? Are single-family homes residential? Always? Are we thinking about the United States or Europe? Which country or state? Debt or equity? Primary or secondary? Owner or operator? There are many more such questions that you can ask with numerous answers – same with regard to the opinions on such classifications.

Real estate means many things. It’s so fragmented from a business standpoint that anything we think of downstream will surely be fragmented as well.

Real estate is a complicated asset class. Moreover, we inherited this world – we didn’t create it. We live in a reality that already existed long before Cherre, and it’s not our role to judge the past – especially knowing very well that the future will surely judge us just as harshly.

No, the reality is that we arrived at this point of time for many good reasons, and it’s our role, collectively, to build a better future.

Not a perfect future, just a better one.

Up next: Low Risk, Low Return: Keeping a Low Profile During the Fintech (R)evolution